You can request to have your part b premiums deducted from your office of personnel management opm annuity as long as you re not entitled to social security or rrb benefits.

Social security not paying medicare premiums.

You can get premium free part a at 65 if.

It goes up for beneficiaries with incomes above 87 000 for someone who files an individual tax return and 174 000 for a married couple filing jointly if you are not yet receiving social security benefits you will have to pay medicare directly for part b coverage.

The standard part b premium as of 2019 is 135 50 but most people with social security benefits will pay less 130 on.

This is sometimes called premium free part a most people get premium free part a.

In 2020 the standard part b premium is 144 60 a month.

The standard part b premium amount in 2020 is 144 60.

Most people pay the standard part b premium amount.

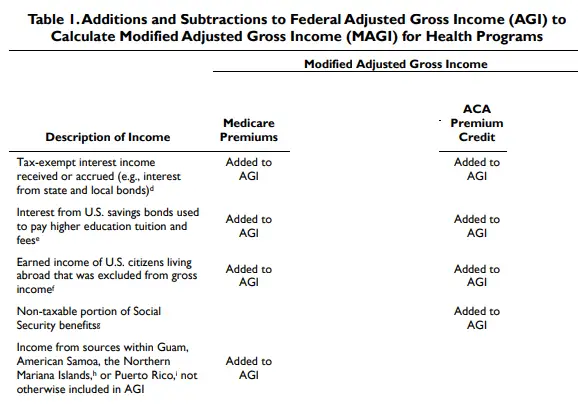

Most enrollees don t pay for medicare part a which covers hospitalization medicare premiums are based on your modified adjusted gross income or magi.

If you are enrolled in part b but not yet collecting social security you ll be billed quarterly by medicare.

If you live in puerto rico you will not receive medicare part b medical insurance automatically.

If you are what social security considers a higher income beneficiary you pay more for medicare part b the health insurance portion of medicare.

Call us at 1 800 medicare 1 800 633 4227 to make your request.

But you usually don t pay any premiums for part a insurance because you likely already paid premiums through social security taxes if you worked for at least 10 years in the u s.

If your modified adjusted gross income as reported on your irs tax return from 2 years ago is above a certain amount you ll pay the standard premium amount and an income related monthly adjustment amount irmaa.

You will need to sign up for it during your initial enrollment period or you will pay a penalty.

This process promotes access to medicare coverage for low income older adults and people with disabilities and it helps states ensure that medicare is the first and primary payer for medicare covered services for dually eligible beneficiaries.

States pay medicare part b premiums each month for over 10 million individuals and part a premium for over 700 000 individuals.

I get my bill from the rrb.

After that only one premium will be deducted each month.

You usually don t pay a monthly premium for medicare part a hospital insurance coverage if you or your spouse paid medicare taxes for a certain amount of time while working.

To sign up please call our toll free number at 1 800 772 1213 tty 1 800 325 0778 you also may contact your local social security office.

Get your premium automatically deducted contact your drug plan not social security if you want your premium deducted from your monthly social security payment.