If you re covered by medicare and you set aside an unreasonably large amount of your workers compensation settlement for future medical expenses using what s called a medicare set aside.

Social security and workers comp settlement.

Social security will look at the language of the worker s compensation settlement document to decide how much of the settlement is subject to offset.

Social security will require documentation of any expenses you wish to deduct from your workers comp settlement so maintain these records carefully.

Unless the settlement involves an award of wages or self employment earnings or if it is a worker s compensation settlement and you are receiving disability benefits it will have no direct affect on your social security benefits.

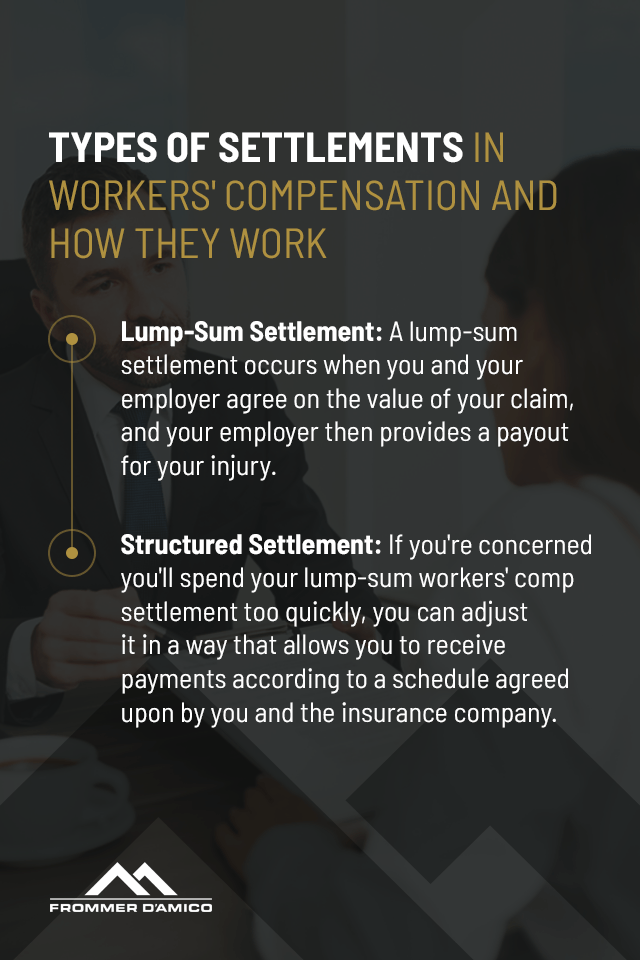

The social security administration received your amended workers compensation lump sum settlement.

Total workers compensation benefits cash and medical combined were less than social security disability benefits during the 1970s but grew steadily throughout the 1970s and surpassed social security disability benefits in the mid 1980s.

In some cases the hard fought efforts at negotiating a favorable workers compensation settlement is only the beginning of the battle.

In some states workers compensation insurance companies will take a reverse offset one reason a workers comp insurer will request permission to access social security records for new claimants in this case social security will pay full disability.

If the settlement amount pushes you over the income limit your ssi and medicaid benefits could be affected.

D oes a workers compensation settlement affect social security disability benefits.

However we consider the original settlement as final.

You have the right to social security retirement or disability benefits as well as workers compensation insurance which pays for the costs of an on the job injury as a wage earner.

Workers compensation and other public disability benefits however may reduce your social security benefits.

Workers compensation benefits are paid to a worker because of a job related injury or illness.

If you accept a lump sum settlement you must report it to your social security caseworker within 10 days.

They may be paid by federal or state workers compensation agencies.

Having negotiated a good settlement the last thing a workers compensation practitioner wants is an angry client frustrated that his or her workers compensation settlement results in a substantial reduction in his or her client s social security.

However federal law requires the state s reverse offset law to have been in effect since before february 18 1981.

Therefore the amended workers compensation lump sum settlement you submitted has no effect on your social security disability benefits.